Tableau for Industries

Insurance analytics

Create digital-first customer experiences, leverage data-driven insights, and manage risk

Analytics in insurance: how a data-driven culture accelerates leadership and innovation

Discover how Progressive—an insurance leader at the forefront of technology, data, and analytics—established a data-driven culture and accelerated its digital transformation journey through AI-driven insights and business intelligence.

Watch now

Building consistency, strengthening risk analysis, and transforming insurance with data

Since 1922, USAA has provided insurance and financial services to military and civilian members. Learn how this industry leader has unlocked the power of visual analytics to create a single source of truth to make faster, better decisions, reduce report delivery time, and build success across the organization.

We implemented Tableau in our analytics group and shared it with the rest of the organization by sharing our visualizations at the executive level. The execs loved them and started asking for deeper-level visualizations, all the way down to individual groups and teams. Getting execs engaged and bought-in was key to our Tableau adoption.

PEMCO fuels business value through fast, accurate claims and seamless server management

Discover how PEMCO, a personal-lines mutual insurance company, uses Tableau to accurately track and monitor all of its ongoing insurance claims, significantly improving closure rates and ensuring high levels of customer satisfaction.

Swiss Life fosters a data culture and improves decision making

A leading provider of life and pensions and financial solutions, Swiss Life has placed data at the center of its business. Learn how they’re driving impactful change, better decision making, and incorporating innovative business practices.

Aon delivers fast, accurate self-serices analytics to employees around the world

Aon is a leading global professional services firm, providing a broad range of risk, retirement, and health solutions. Find out how they improved data trust, reduced time to insight, and cut development times with its flagship embedded platform, powered by Tableau.

Additional

resources

Solutions

Featured Solution

Transform financial services contact centers with data

How can you use data to differentiate your contact center? Learn four strategies that will help you transform your service organization with analytics.

Products and

use cases

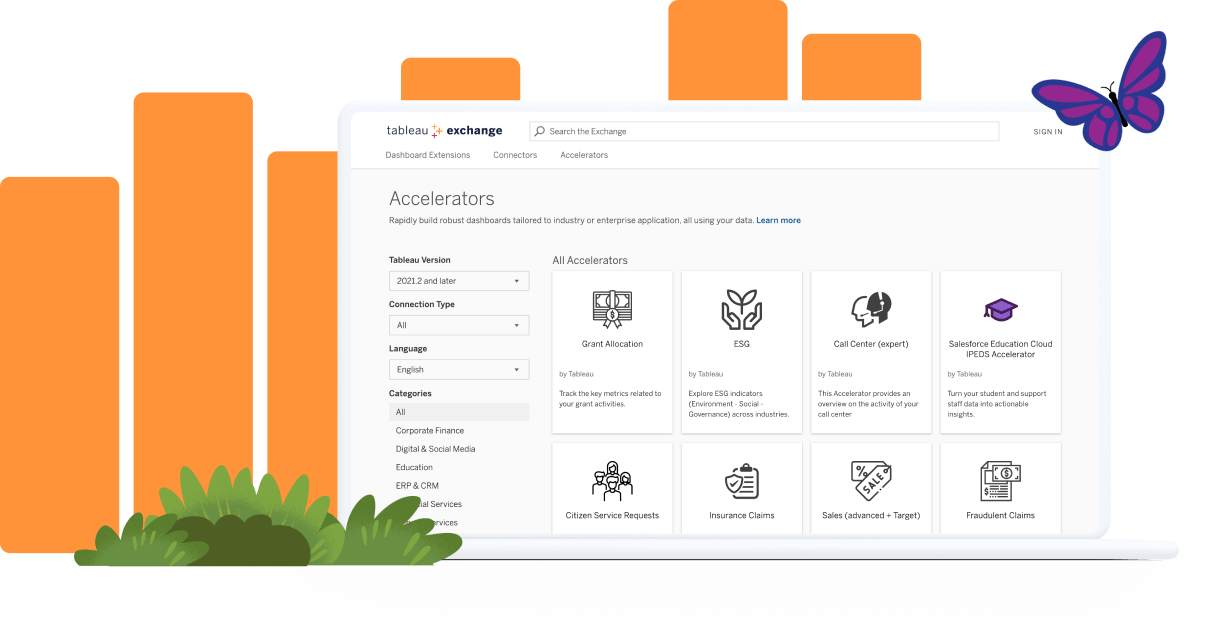

Jumpstart analysis with Tableau Accelerators

Get expert-built dashboards to address insurance-specific business needs with Accelerators on the Tableau Exchange.

Explore AcceleratorsFinancial services webinars

Tableau Partner Network

Need help solving your toughest data challenges? We’ve got you. With more than 1,200 partners—including resellers, services, and technology—it’s easy to get the right support for your business.

Find a partnerVisualize insurance data

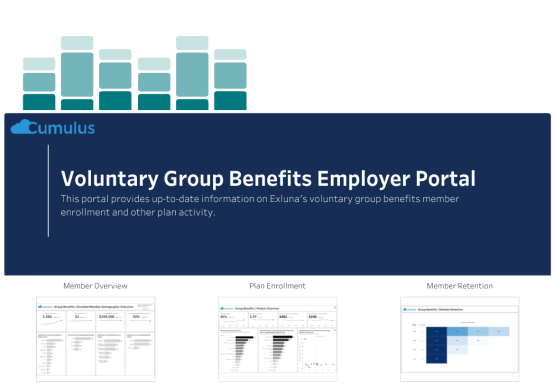

Voluntary Group Benefits Employer Portal

Discover how group benefits insurers can power a differentiated experience for employers/plan sponsors that enable self-service, lower the cost of collaboration, and accelerate the path of going from data to insights to action, resulting in higher NPS, higher participation rates, and member retention for the carrier.

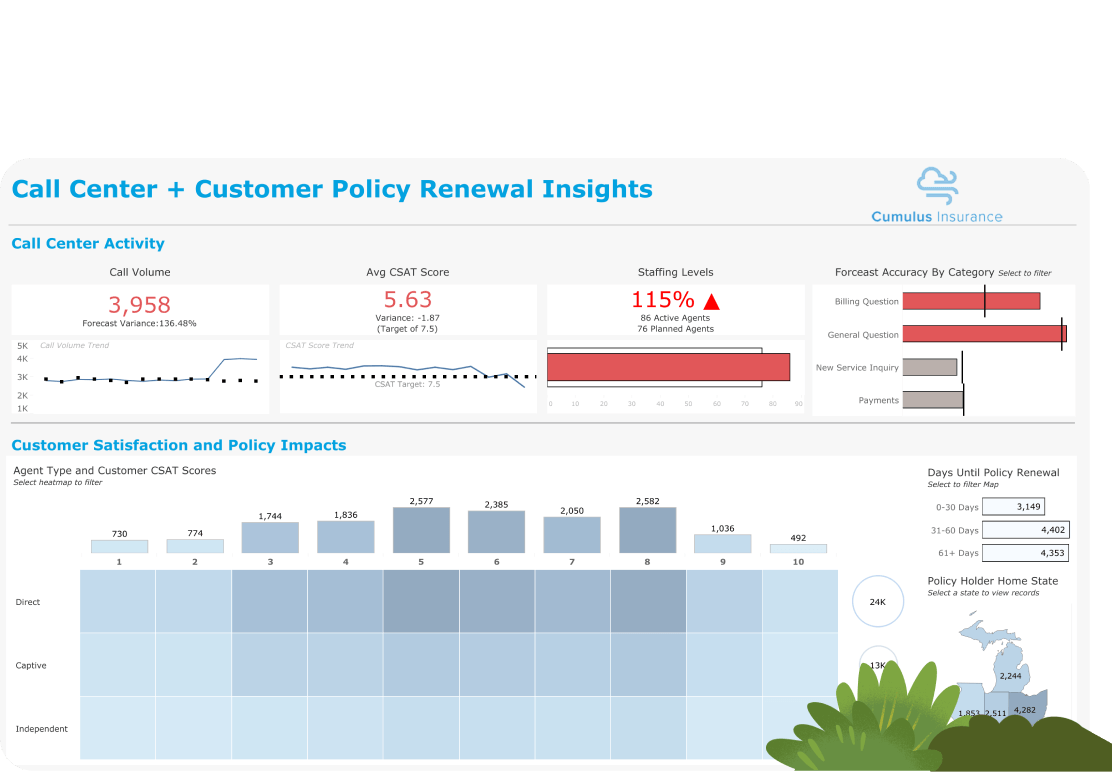

Explore the vizCall center and policy renewal

Unlock actionable call center and policy renewal insights that allow you to visualize and better understand customer satisfaction, policy impacts, call volume, and, staffing levels giving you the tools to drive operational excellence and customer success.

Explore the viz

Salesforce and Tableau

A complete intelligence platform built on the world’s #1 CRM, Salesforce, CRM Analytics offers insurance companies a native analytics experience. To boost productivity, Salesforce users can surface intelligent, actionable insights—right within their workflow. Explore Salesforce solutions for insurance.